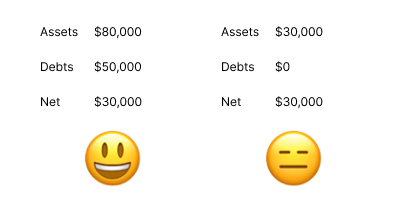

The perverse role of debt in feeling wealthy

I had the pleasure of meeting up with Abby Sussman of Princeton last night, who investigates the psychology of wealth - assets and liabilities. Her recent piece in Psychological Science sums it up well: We studied the perception of wealth as a function of varying levels of assets and debt. We found that with total gross wealth held constant, people with positive net worth feel and are seen as wealthier when they have lower debt (despite having fewer assets).